Award-winning PDF software

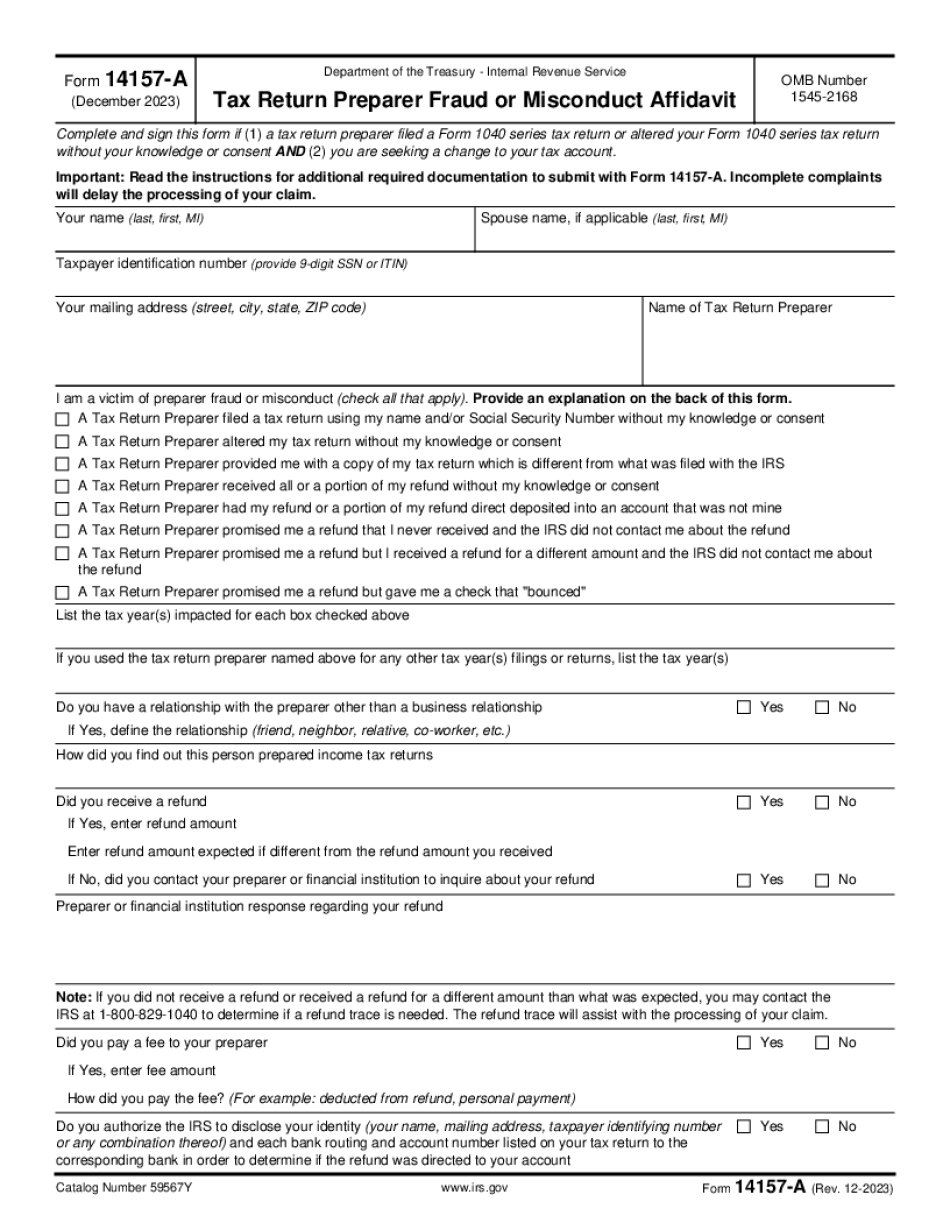

ID Form 14157-A: What You Should Know

There are no corrections or omissions. 1. You have no reason to believe that an erroneous tax return was filed as a result of identity theft. 2. There's no evidence that the preparer received a return or a substitute return or any tax return or substitute tax return from the IRS. 3. You did not sign any information on the return or substitute return. 4. A copy of your tax return or substitute tax return does not show an individual taxpayer account number (ITC number). 5. The preparer did not prepare the return or substitute return and was not the tax return preparer or substitute return preparer for the taxpayer. 6. The preparer was not authorized to prepare a tax return or substitute return. Include any other information that may help with the investigation. Do not write on the form. Do not sign your return until the time it is processed by the IRS. Do not sign more than one time on a return. Pay with a check or money order made out to: IRS. IRS Tax Examination. P.O. Box 979050. Louisville, KY 40240. If you have been a tax return preparer, you may also want to read these documents: The Taxpayer Advocate Service Taxpayer Advocate's Handbook for Taxpayers Who File Tax Returns (2015 edition) This book is a powerful tool. It is a legal aid to taxpayers and guides them in making effective, informed decisions about their tax situation. The book is highly recommended for consumers and businesses filing tax returns. The Taxpayer Advocate Service has put together a comprehensive training course for all taxpayers and individuals who are preparing tax returns. The course takes 30 to 45 minutes to cover some basics. You can review the video and/or audio or read the PDFs and take the course here. The Taxpayer Advocate Service Training Book — (2017 edition) (2017 Edition) This guide is a great resource for those who prepare tax returns and are in situations where they are dealing with people who are tax preparer or other tax preparation business and tax return preparer. This book includes a series of chapters that addresses the various scenarios that can occur when someone becomes involved in someone else's tax return preparation or business. The Taxpayer Advocate Service has assembled a complete course in this book that can be ordered here.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete ID Form 14157-A, keep away from glitches and furnish it inside a timely method:

How to complete a ID Form 14157-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your ID Form 14157-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your ID Form 14157-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.