Award-winning PDF software

Greensboro North Carolina online Form 14157-A: What You Should Know

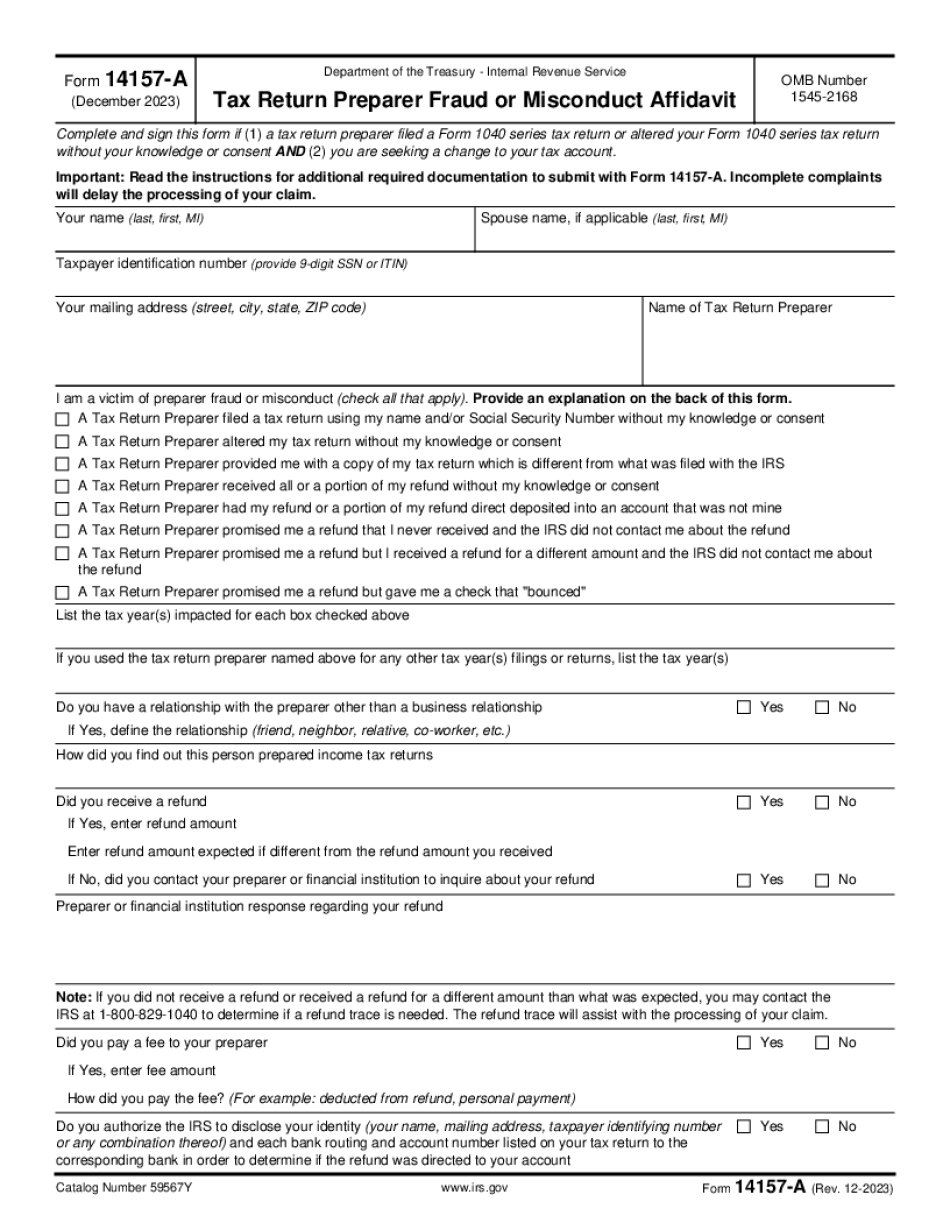

Form 14157-A will be used to communicate with the taxpayer about a ghost preparer. SUMMARY OF THE FOUR TAX PROVISIONS UNDER THE INTERNAL REVENUE CODE: TAX RULE 5(D)(1) — A person is required to keep records as required by this Code in accordance with these rules and regulations. Taxpayer Notifying the Taxpayer, the Tax Counseling Agencies, or any Taxpayer Representative of the Facts A person filing Form 14157-A may include any written communications they have received from the taxpayer regarding the facts surrounding their return. When preparing a tax return, Form 14157-A must be completed by the taxpayer or certified under penalty of perjury by the taxpayer. A taxpayer may not enter into a contract regarding the taxpayer-taxpayer return preparation process with a subcontractor to prepare taxes to the extent that the subcontractor: Includes a statement on the taxpayer's return (or other statement) stating that the subcontractor has not performed an audit or other independent review of the taxpayer's return (or other statement) If a contractor fails (1) to provide a copy of the taxpayer's Form 2951 or (2) to provide an explanation of the results of the audit or other review, unless the taxpayer has expressly requested the information (or written communication from the taxpayer) The taxpayer must advise the Tax Court that the contract was made, including that if the taxpayer is not sure, the taxpayer should contact the Contractor's attorney. The taxpayer will be liable for all fees, commissions, or expenses incurred in preparation of the return, regardless of any agreement on the contract. The taxpayer will be required, upon request, to provide a copy of the contract with the contract number and all applicable signatures, etc. DUPLICATING AN OBJECTION FORM 14157-A If you want to make a correction on this Form 14157-A, you must complete the entire original, and not try to go by the “back cover” of the 14157-A. You have to fill out this entire 14157-A, and no matter if you copy from the front or the back cover... If you do this, and you make a mistake, DO NOT SEND IT! Don't give the IRS permission to file another Form 2852 or other incorrect form.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Greensboro North Carolina online Form 14157-A, keep away from glitches and furnish it inside a timely method:

How to complete a Greensboro North Carolina online Form 14157-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Greensboro North Carolina online Form 14157-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Greensboro North Carolina online Form 14157-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.