Award-winning PDF software

Form 14157-A for Lewisville Texas: What You Should Know

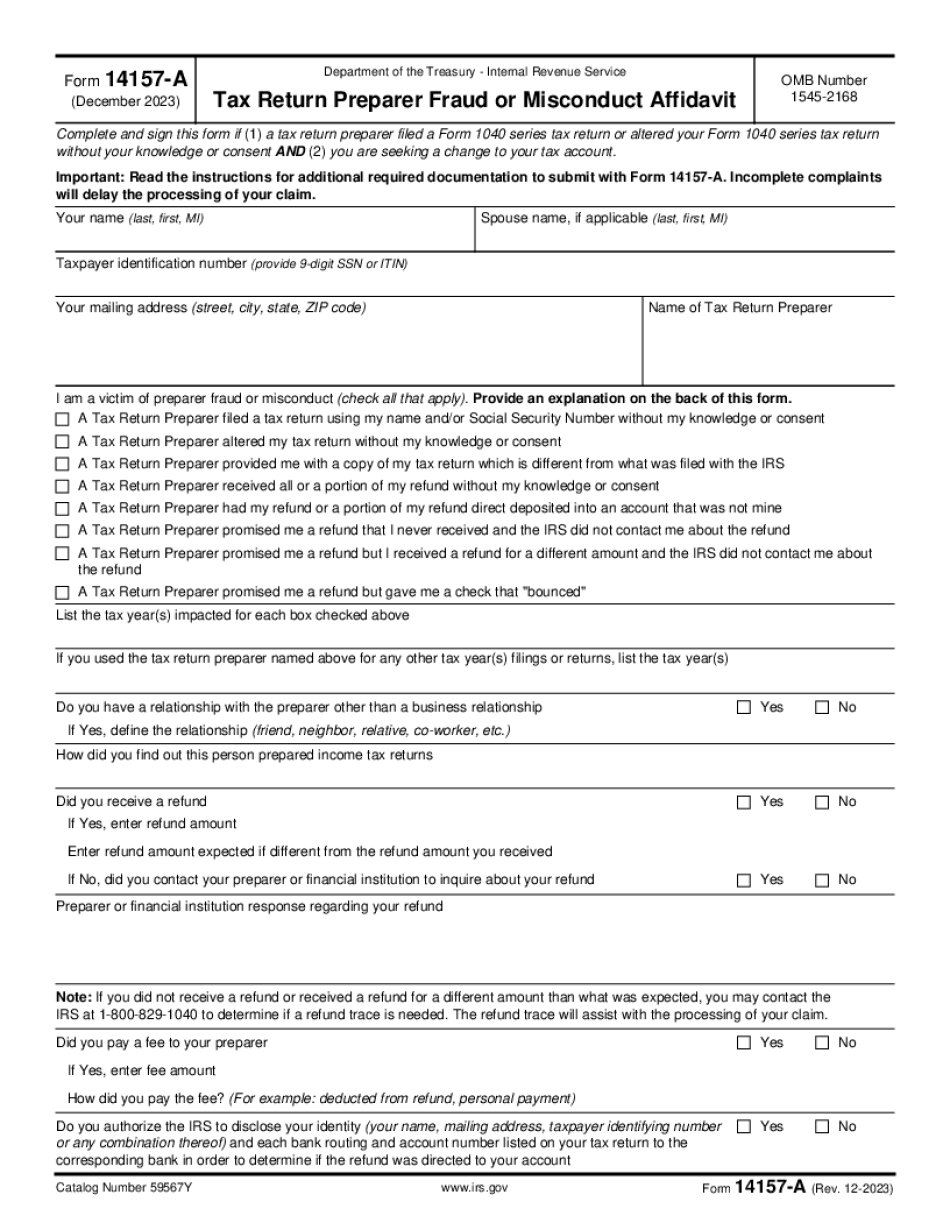

IRS Form 14157 is a tax return preparation complaint form submitted by individuals, sole proprietors, and single member limited liability companies (LLC) to the IRS when there is information that a tax preparer has deliberately or inadvertently submitted or failed to produce the return or account to which the complaint relates. Form 14157 and its attachments are submitted to the IRS by qualified taxpayers. If you have information concerning a tax return preparer's criminal behavior or misconduct, then you have the right to request additional information or evidence from the IRS. You also have the right to file a complaint with the IRS. The IRS will determine if additional investigation is necessary. This includes, but is not limited to, obtaining any additional information relating to the information on the Form 14157. When making a tax return or refund return you have a right to file one that meets all tax laws, including the Internal Revenue Code, and other applicable laws and regulations. This means that you have the first right, and on top of that it gives you the right to file any return that you want, including an amended return. If you are dissatisfied with the return or refund return that you filed, you have the right to file a complaint with the IRS. The IRS is the agency responsible for ensuring compliance with the Internal Revenue laws by ensuring the proper filing and preparation of tax returns. With this said, the IRS has the responsibility to be alert to the existence of possible criminal activity on the part of tax preparers in order to promptly and effectively deal with individuals who may be involved in wrongdoing. The IRS also has the responsibility to investigate any concerns they have regarding conduct of tax return preparers. The IRS will investigate any and all instances of possible tax return preparer misuse of taxpayer funds. If you are an individual with information about this activity you may be able to assist the IRS in their investigation. When any IRS employee, agents, or workers receive information indicating a reportable offense involving a tax return preparer, you will be asked to sign a form. This form is called a Complaint Form. It is not a formal investigation which will then make a formal finding against a tax return preparer. The Complaint Form will serve three general purposes.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 14157-A for Lewisville Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 14157-A for Lewisville Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 14157-A for Lewisville Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 14157-A for Lewisville Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.