Award-winning PDF software

Form 14157-A Anchorage Alaska: What You Should Know

Form 1683 — Tax Fairness Act — IRS.gov Use form 1683 or Form 6427, Consumer Tax Fairness Act. Once you have been contacted by federal and state officials, take the time to file this form as a form of protest against the improper filing of Form 1683. These forms are very similar to Form 6427, Consumer Tax Fairness Act, which can be found here. Form 1683 can be completed by both individual taxpayers and corporate taxpayers. IRS Form 2115 — Taxpayer Filing Declaration — Forms 4673 (Estate and Trust) and 4696 (Sale and Exchange of Land) You need to check with your state to see if filing with Form 2115 is required. If your state requires a tax return preparer to file with Form 2115 the Form 3115 or a Form 4867 — Payment Withholding for Federal Income Taxes Once the IRS finds out that you are delinquent on your taxes — and there is no other way the IRS can get your tax information — they have a number of actions you can take to recover and/or avoid further penalties. IRS Form 9829 — Statement of Cash Payments (Payments For Qualified Residential Mortgage Interests) and Filed on or Before December 1. If you make payments on a residential mortgage and made in amounts larger than the maximum that can be taken without interest being withheld, you may have to report to the IRS the actual amounts you made. The statement is due in due course and must be deposited in your bank within 90 days of the due date. Tax Forms and Publications — Skip worth & Associates, LLC A return preparer has the option to prepare IRS Form 9829, Statement of Cash Payments. The required information to complete the form is required on page 3, which is called “Form 2102.” The return preparer will use Form 4867, Payment In Kind, as their payment source for Form 2102. Pay with Form 4867 will cause the Form 9829 to be deposited in the taxpayers bank within 90 days of the due date. You can also check with your state to see whether they require taxpayers to file an “OCC” with their state. Tax Fairness Act — IRS.gov This tax advocate tool and its companion form can be found here.

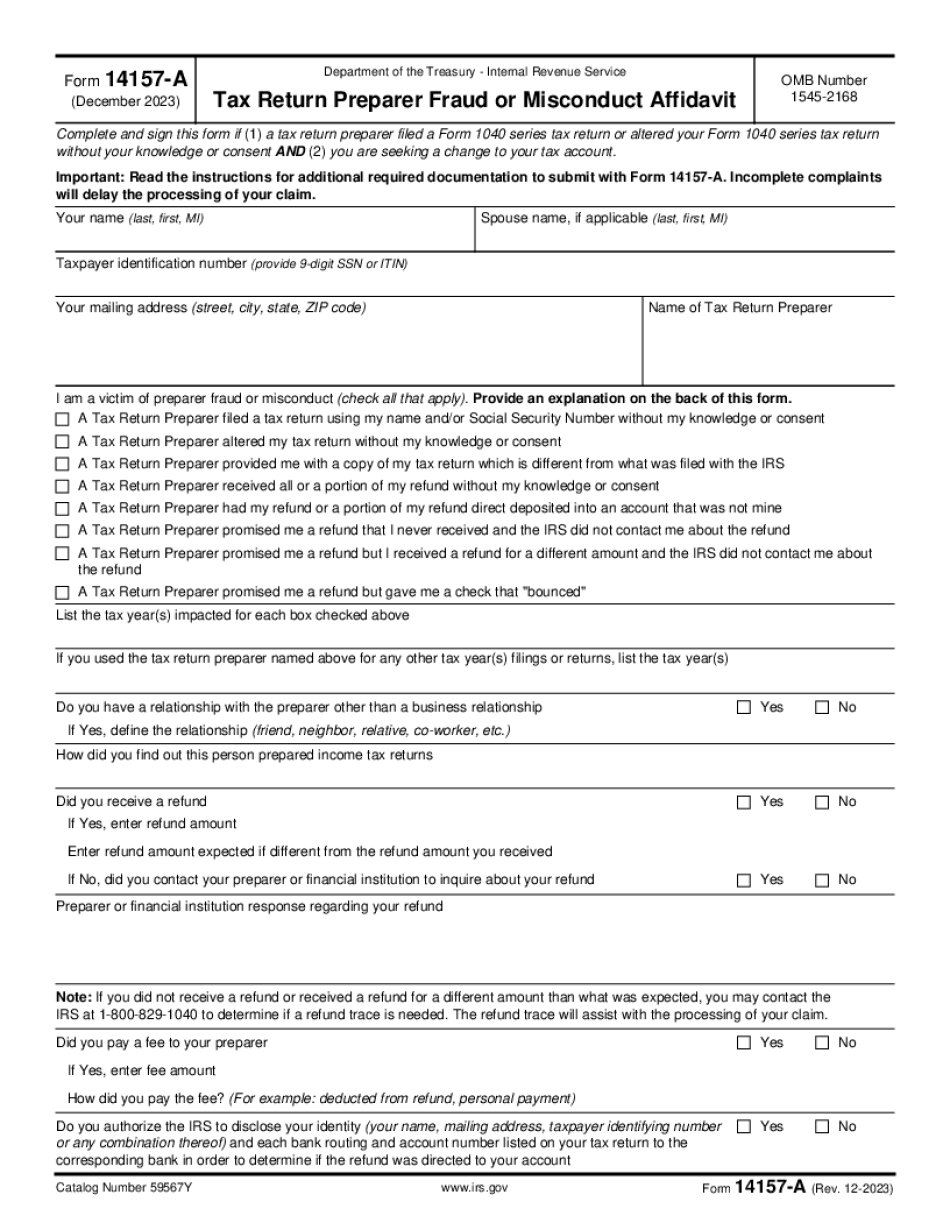

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 14157-A Anchorage Alaska, keep away from glitches and furnish it inside a timely method:

How to complete a Form 14157-A Anchorage Alaska?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 14157-A Anchorage Alaska aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 14157-A Anchorage Alaska from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.