Hey guys, you know there is a way to find out if your tax preparer is not lying. Okay, so it's really simple. You will need to enter your social security number, your filing status (this can be single, head of household, or married - it's really up to your status), and finally the exact amount of your refund. Okay, once you enter this information, you will see if your tax has been accepted or when you will receive it. Okay, it's really easy. If you enter all the information and you don't get any result, there is something wrong. There is something wrong, so check the tax paperwork. So now I'm gonna let you with one officer for miles. We're gonna explain to you how to find out your tax refund. Hi, I'm Michelle, and I work for the Internal Revenue Service. Are you expecting a refund this year? If so, you can check on the status of your refund using the IRS "Where's My Refund" tool. When you use this tool, you'll get the most up-to-date information we have about your refund. You can start checking on the status of your return within just 24 hours after we received your e-filed return or about four weeks after you mail a paper return. Just use the IRS2Go phone app or go to irs.gov/refunds. Both are available 24 hours a day, seven days a week. The system is updated every 24 hours, usually overnight. You'll need your tax return handy so you can provide your social security number, filing status, and the exact amount of your refund. The "Where's My Refund" tool will give you personalized refund information based on the processing of your tax return. Once you enter your information, a tracker will show you where your return is in...

Award-winning PDF software

Can my tax preparer steal some of my refund Form: What You Should Know

The IRS warns people not to hand over any personal information about themselves or their personal assets to a tax preparer. The IRS also warns that fraudsters may attempt to get you to pay fees in order to avoid the costs of a refund through your returns. If you suspect someone you know has committed fraud against you, get in touch with the FBI at 1-800-CALL-FBI (), file a complaint with the IRS via the report a tax fraud website, or contact the Internal Revenue Service Taxpayer Assistance Unit at.

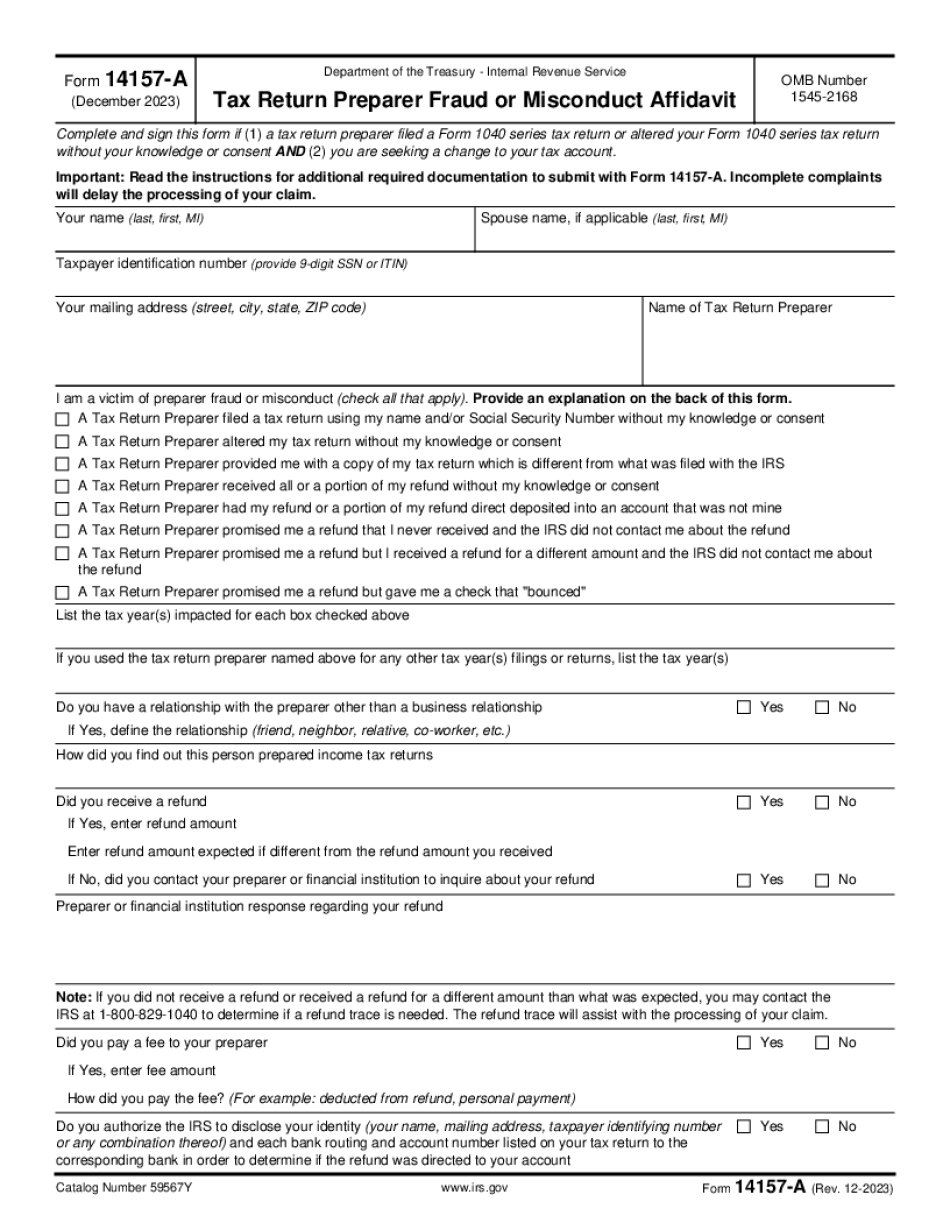

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14157-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14157-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14157-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14157-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Can my tax preparer steal some of my refund