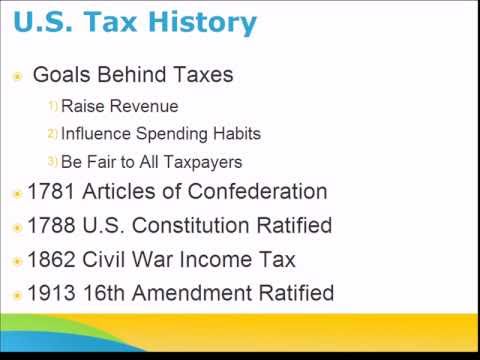

Hi, my name is Tammy. I am your Max Axe trainer. I just want to welcome you once again to the Max Tax family and congratulate you for taking the steps to becoming a Max Tax agent. Becoming a tax preparer is both a challenging and rewarding journey that you'll never forget. Now, before we get started, I just want to remind everybody that if you are not already signed up for our mailing list, please make sure to go to our website maxtaxrefundguarantee.com/jobs so you can receive your instructional material directly to your in. Now, let's go ahead and get started. Alright, let's go ahead and go over the topics for this video. In this video, we're going to cover a brief history of US tax history. When I say "brief," I mean very brief. Then we're going to go over the Max Tax difference, the compensation plan which I'm sure everybody is interested in, and the irs.gov website for your reference material. Alright, so a brief history in US tax taxes in US history. Taxes and Taxation have been important issues in America's past, present, and future. If you recall from your high school social studies class, taxes can be cited as one cause of the American Revolution. You may recall things like the Boston Tea Party or one columnist shouting, "Taxation without representation is tyranny." Taxes date back as far as 2000 BC, where tax collectors first appeared in ancient tomb paintings. The current tax system in the US has developed over the course of more than 200 years. Over this time period, lawmakers have always strived to achieve three main goals. First, to raise revenue for things like roads, bridges, schools, police, and other public services. Second, to influence spending habits. For example, if the gas tax was to...

Award-winning PDF software

Tax preparer similar occupations Form: What You Should Know

As an IRS employee, Your Own Guide to Tax Advice For You And Your Family 11 Tax-Related Careers (Without Salaries and Duties) | Indeed.

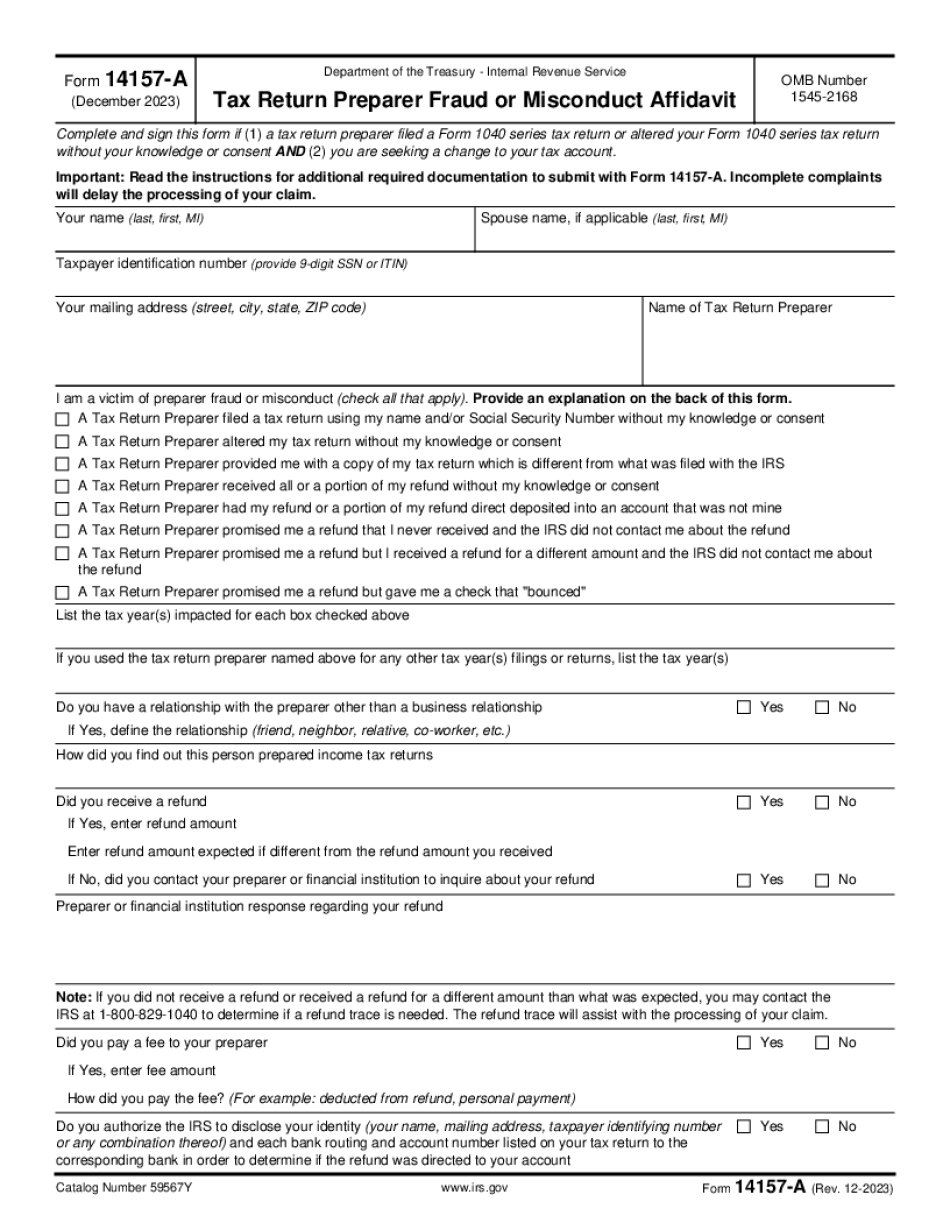

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14157-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14157-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14157-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14157-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Tax preparer similar occupations