Well, this is Fred Wahl, and welcome to Tuesday's Tax Tips. Today, I wanted to spend some time talking a little bit about the benefits of using a tax preparer. To me, I think there are two very important benefits to think about. One of the first benefits is the personal touch of a tax preparer. They will help you maximize your finances. They can help clients think about retirement planning, college planning, and saving for their kids' education. Additionally, they can assist with saving money, getting out of debt, and other important financial matters. So, I believe that the personal touch of a tax professional is one of the main advantages. The second benefit is the convenience, peace of mind, and confidence in knowing that your taxes were done correctly and efficiently. When you use a tax professional, you can rely on their expertise and knowledge to ensure that everything is handled accurately. This provides you with peace of mind and lets you know that your taxes are in capable hands. Therefore, the convenience and peace of mind associated with using a tax preparer is another advantage to consider. If you are considering doing your taxes on your own, I strongly urge you to take these factors into consideration. Using a tax professional offers personalized assistance to maximize your finances, as well as the convenience and peace of mind of knowing your taxes are being done correctly. So, before making any decisions, weigh the benefits of using a tax preparer versus the potential challenges of doing it yourself. Thank you for tuning in to Tuesday's Tax Tips with Wallet Tax and Financial. I look forward to speaking with you again soon.

Award-winning PDF software

My tax person messed up my taxes Form: What You Should Know

Borrowers that applied for loans using SBA Forms 2483-C or individual, general partners, or owner-employees of an S-corporation, who made at least 150,000 loan, to be renewed each year by December 31, 2019, will be precluded from receiving a refund for the tax year during which the loan was made. Borrowers who do not receive a refund for the tax years in which the loan was made and who were not otherwise exempt from tax under Section 382 of the Internal Revenue Code, may file Form 4852 (with accompanying proof of exemption) to request a refund. For more information, please click here. Form 4852 Application for Tax Refund Please click here for instructions and required documents for applications to request a refund for a Section 382 tax on the loans made using SBA Form 2483-C or to petition the Tax Court for a refund of any tax paid due to the SBA disaster program. July 30, 2025 — Form 4852-S is for customers receiving tax refunds due to the SBA disaster program. You do not need to have received a refund but must provide the following documents to SBA to be eligible to request a refund: (1) a copy of the Form 4852S with the tax returns you filed that were due for the tax year for which you want a refund and (2) proof of your exemption from Section 382 of the Internal Revenue Code. A request for a refund of the tax withheld must be received by SBA by no later than January 3 of 2020. The SBA Disaster Loan Program is a program designed to assist small businesses in meeting the costs associated with emergency situations, such as hurricanes and wildfires. Small and disadvantaged business must agree to share the risk of default in the event SBA, its affiliates, or its owners or managers of an S-Corporation is forced to pay all or a portion of the outstanding debt. This program offers loan forgiveness and/or consolidation at no cost to SBA and with the option to purchase back the S-Corporation from the Lender.

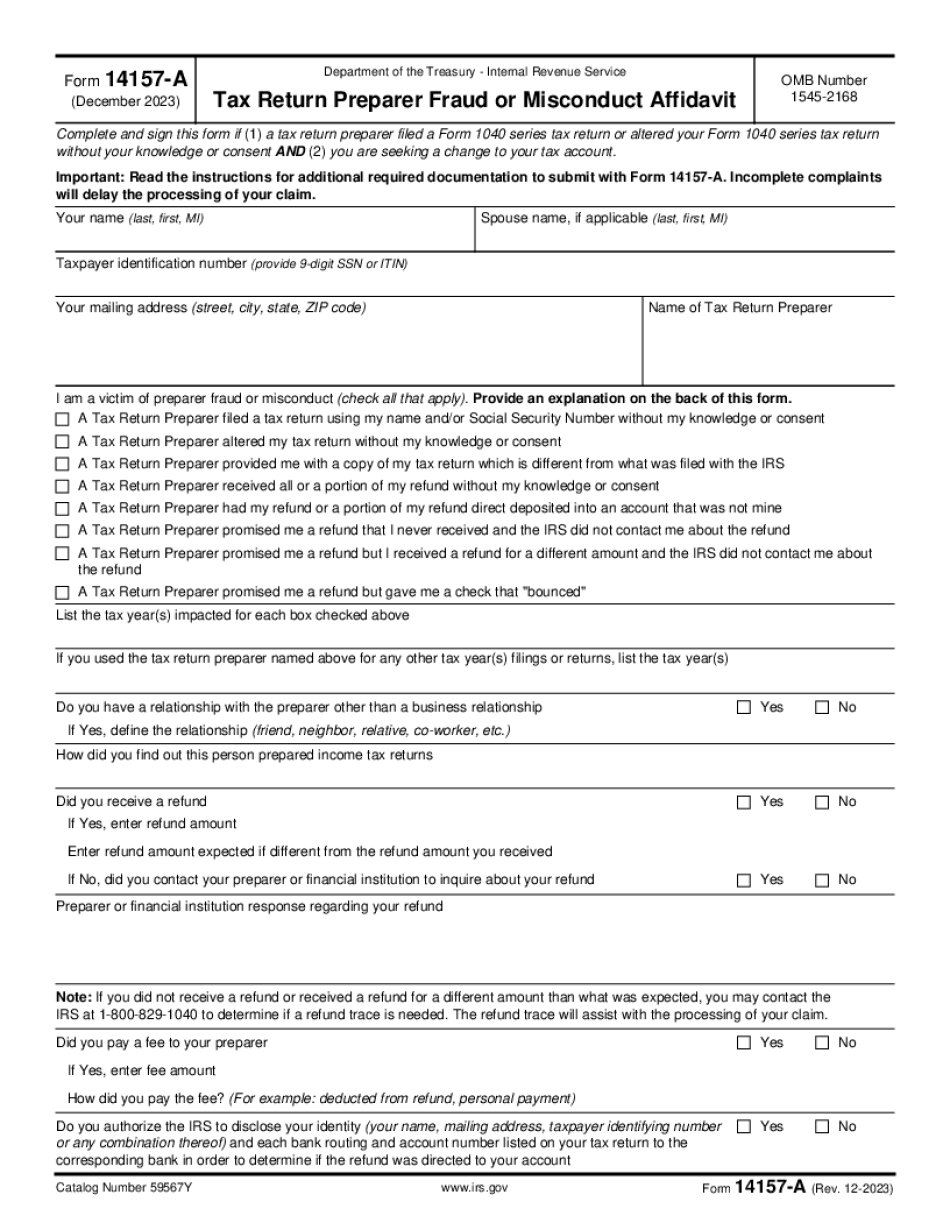

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14157-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14157-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14157-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14157-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing My tax person messed up my taxes