Music, my fellow Americans. Tonight, I am speaking to you because there is a growing humanitarian and security crisis at our southern border. All Americans are hurt by uncontrolled illegal migration. It strains public resources and drives down jobs and wages. Our southern border is a pipeline for vast quantities of illegal drugs, including heroin, cocaine, and more. Americans will die from drugs this year than were killed in the entire Vietnam War. We have requested more agents, immigration judges, and bed space to process the sharp rise in unlawful migration filled by our very strong economy. Music, law enforcement professionals have requested 5.7 billion dollars for a physical barrier. At the request of Democrats, it will be a steel barrier, rather than a concrete wall. The border wall would very quickly pay for itself, as the cost of illegal drugs exceeds 500 billion dollars a year. The wall will also be paid for indirectly by the great new trade deal we have made with Mexico. Music, the federal government remains shut down for one reason and one reason only, because Democrats will not fund border security. My administration is doing everything in our power to help those impacted by the situation, but the only solution is for Democrats to pass a spending bill that defends our borders and reopens the government. Day after day, precious lives are cut short by those who have violated our borders. Music, how much more American blood must be shed before Congress does its job? To every member of Congress, pass a bill that ends this crisis. Thank you and good night. Music, thank you and good night. Music.

Award-winning PDF software

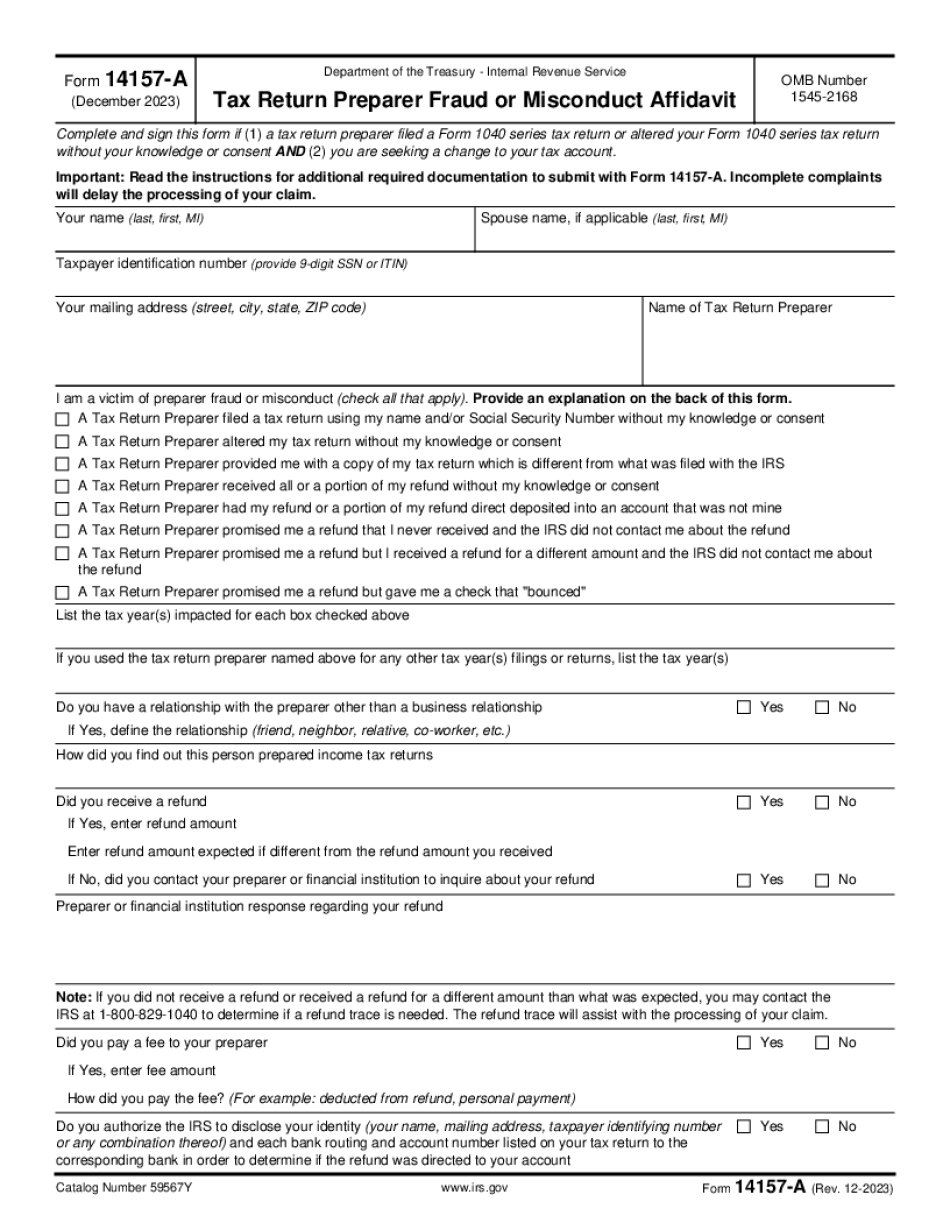

Accountant lied on my taxes Form: What You Should Know

Is Your Tax File Preparer Being Harassed? — H&R Block Sep 30, 2025 — A tax preparer should not harass you about your tax return, and do not make threats if you need to make a complaint. Is Your Preparer Being Irresponsible? — TaxProTax Mar 21, 2025 — If you think your preparer is not being truthful about a material fact, fill out Form 7243. Is Your Preparer Lying to You About Your Taxes? — AARP Sept 5, 2025 — Taxpayers can complain to the IRS and claim penalties when preparers lie, make misleading statements, have a poor record of performance, or fail to comply with applicable laws and regulations that apply to tax preparers. Five Things You Should Know about the IRS Audit Process May 2, 2025 — The IRS auditing process is long and difficult. This is particularly true for anyone who has an IRS-related issue and needs to report it. The average tax return audit is over five months long. You will need to be patient while the IRS conducts all required due diligence One of the Three Tasks of the IRS Audit Process — TaxAdvts. Com Oct 12, 2025 — If you need to make a complaint about a tax return preparer, your first step is to contact the IRS and schedule a call. Keep in mind that the IRS's first priority is to ensure fair and impartial treatment of taxpayers. If you can show the preparer acted inappropriately, the audit can be reopened. It is also not uncommon to obtain an independent assessment from an outside law firm about the preparer's integrity or lack thereof. Five Tips to Get the Job Done Fast — The Institute for Taxation and Economic Policy Dec 5, 2025 — If it takes more than a week for the IRS to review your complaint, you have a very good chance of losing your right to file a written complaint. In most cases, your written complaint is sent straight to either the person who prepared your tax return or to the tax professional the preparer is working with. Five Steps You Can Take to Get a Tax Filing That Looks “Right on Paper” Feb 15, 2025 — The IRS has a reputation for being slow and inefficient when it comes to processing tax returns filed on time. Don't expect to avoid paying the IRS your taxes by following simple tricks. Some of these tricks work, but sometimes they backfire.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14157-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14157-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14157-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14157-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Accountant lied on my taxes